The Ideal ATR Multiplier for a Stop-Loss

How can you tell if your stop-loss is effectively protecting you?

Many traders use ATR-based stop-losses, but selecting the right multiplier can be challenging, especially when considering the associated risk factors, such as the balance between loss size and stop-out frequency.

In this post, we will analyze ATR multipliers to help you identify a suitable setting that aligns with your trading style.

If you are unfamiliar with the terms TR or ATR refer to the linked posts

Analysis Approach

The Question:

What is the probability that the True Range (TR) will exceed the Average True Range (ATR) on a given trading day?

Methodology:

The True Range (TR) was chosen because it reflects the maximum price movement a stock can experience within a single trading day. By “maximum,” we mean that the price could start and move in one direction without retracing, reaching its highest (or lowest) potential level.

To answer the question, we used the following condition to determine if the daily price movement was large enough to trigger a stop-loss set at a given ATR multiple:

If TR > ATR x k , return (True); else (False).

Where k is the ATR multiple being tested. This condition was then used to calculate the hit rate, which we define as the percentage of days the True Range exceeded a specific multiple of the 14-day ATR.

The hit rate is calculated as follows:

Hit Rate (%) = ( Σ (TR > ATR × k) / Total Days Analysed ) × 100

where k is the ATR multiple being tested.

We analysed daily price data for S&P 100 constituents over 5 years, representing five years of daily price data for each of the S&P 100 constituents, resulting in a total of 124100 data points.

ATR multiples ranging from 1x to 2x, incrementing by 0.1x, were examined.

Analysis Summary

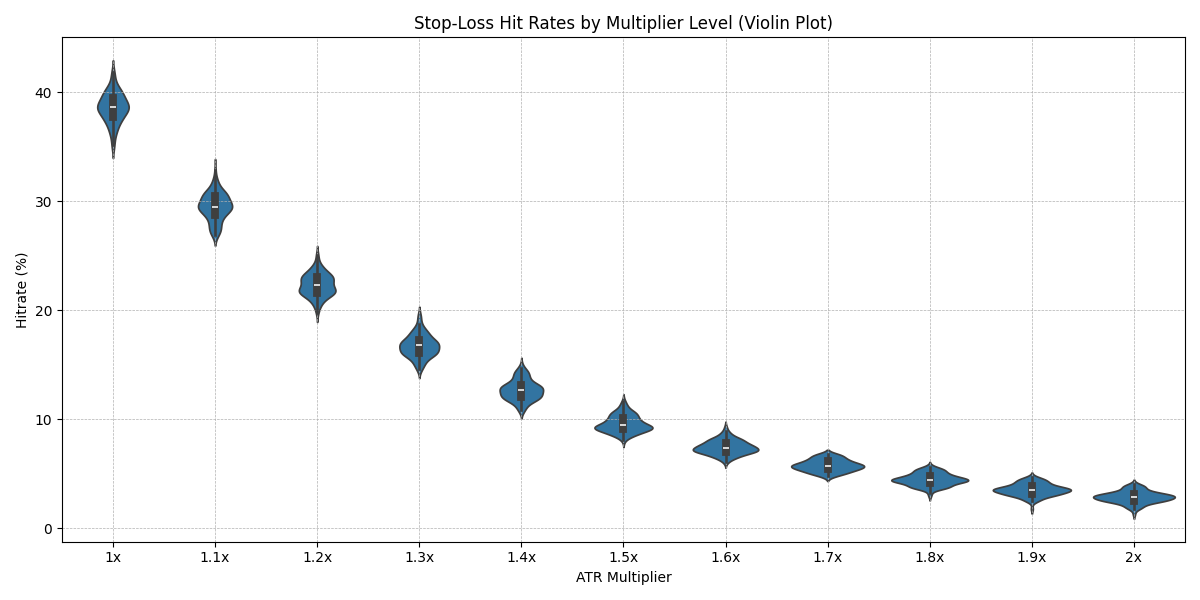

The violin plot above illustrates the distribution of hit rates across all tickers for each ATR multiplier.

The most prominent trend is the inverse relationship between the ATR multiplier and the hit rate: the hit rate decreases as the ATR multiplier increases. This aligns with the intuitive understanding that wider stop-losses (higher ATR multiples) are less likely to be triggered than tighter stop-losses (lower ATR multiples).

The analysis yielded the following average hit rates for the ATR multipliers examined:

| Multiplier | Average Hit Rate (%) | Standard Deviation |

|---|---|---|

| 1.0x | 38.60 | 1.38 |

| 1.1x | 29.50 | 1.25 |

| 1.2x | 22.32 | 1.04 |

| 1.3x | 16.73 | 1.02 |

| 1.4x | 12.68 | 0.91 |

| 1.5x | 9.59 | 0.76 |

| 1.6x | 7.43 | 0.63 |

| 1.7x | 5.77 | 0.53 |

| 1.8x | 4.47 | 0.55 |

| 1.9x | 3.54 | 0.55 |

| 2.0x | 2.86 | 0.53 |

As the table illustrates, the average hit rate initially drops sharply. For example, increasing the ATR multiplier from 1.0x to 1.1x reduces the hit rate from 38.60% to 29.50%, a difference of 9.1%.

However, this effect diminishes as the multiplier increases. The decrease from 1.9x to 2.0x ATR is only 0.68% (3.54% – 2.86%).

This illustrates the principle of diminishing returns: widening our stop-loss is only beneficial up to a certain threshold. Beyond that, the added protection against premature stop-outs diminishes significantly, making further increases less impactful on the overall risk profile of the trade.

The Ideal Multiplier

Determining the ideal ATR (Average True Range) multiplier involves balancing your risk tolerance with your trading style.

For example, traders who aim to capture quick breakouts and prefer not to experience price retracements may opt for a tighter stop-loss of around 1x ATR. This choice results in a higher probability (38.60%) of the stop being triggered but also limits potential losses associated with false breakouts.

Conversely, traders anticipating intraday volatility might initially select a wider stop-loss, such as 1.5x ATR. This approach accepts a lower probability (9.59%) of being stopped out, allowing for more room to accommodate price fluctuations.

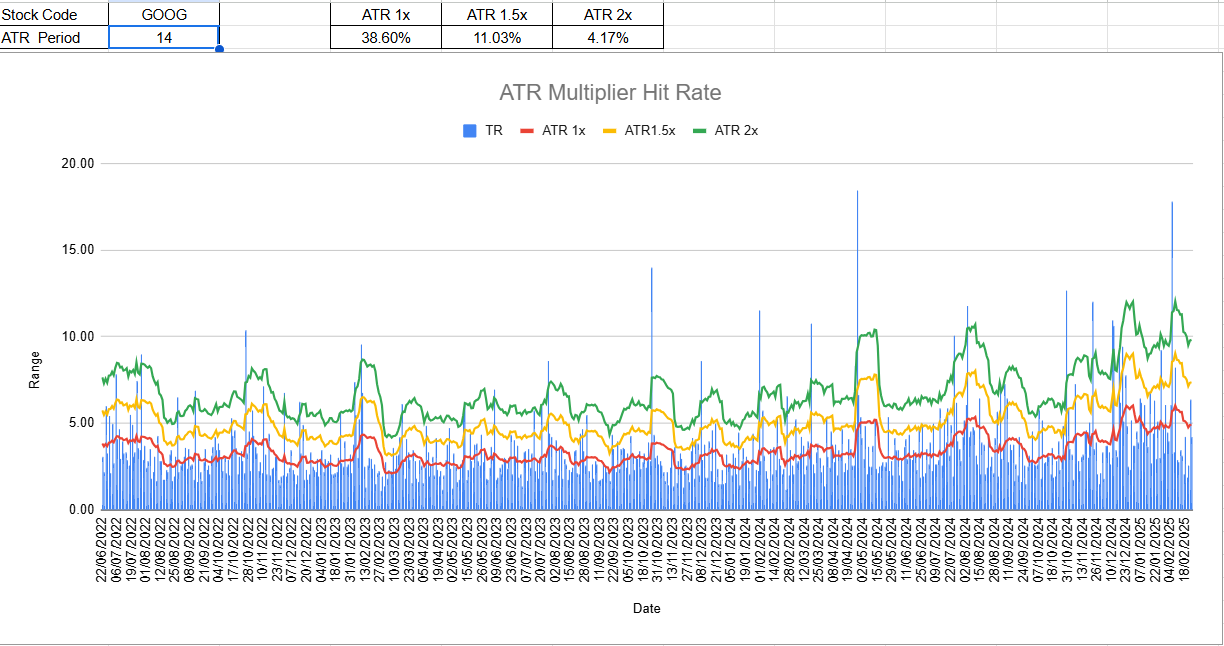

Spreadsheet

While the aggregated results presented above provide a comprehensive overview of ATR multiplier behaviour, they may not capture the unique characteristics of individual stocks. To address this, we’ve developed an interactive spreadsheet tool that allows you to analyse ATR multipliers per stock.

This will allow you to further optimize your stop-loss placement by focusing on recent price behaviour. Spreadsheet Documentation