Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence is a trend-following momentum indicator that shows the correlation between two moving averages and was created by Gerald Appel in the late 1970s. Its purpose is to help traders quickly identify the direction of the trend and its momentum. Since then, it has become one of the most popular technical analysis tools due to its simplicity, versatility, and depth of information.

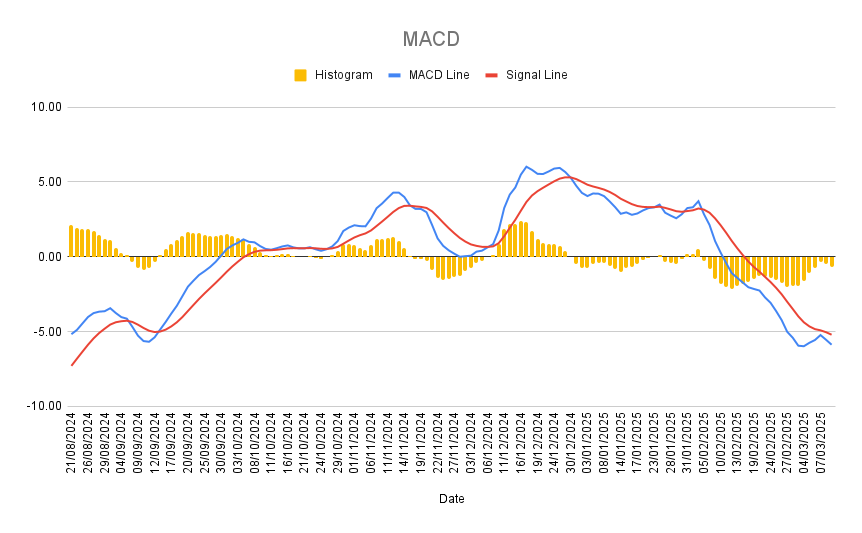

The MACD consists of three components:

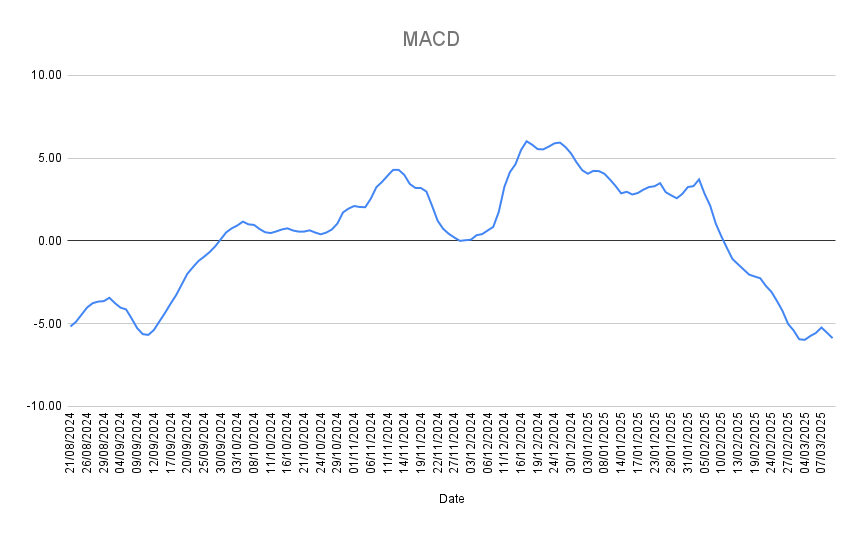

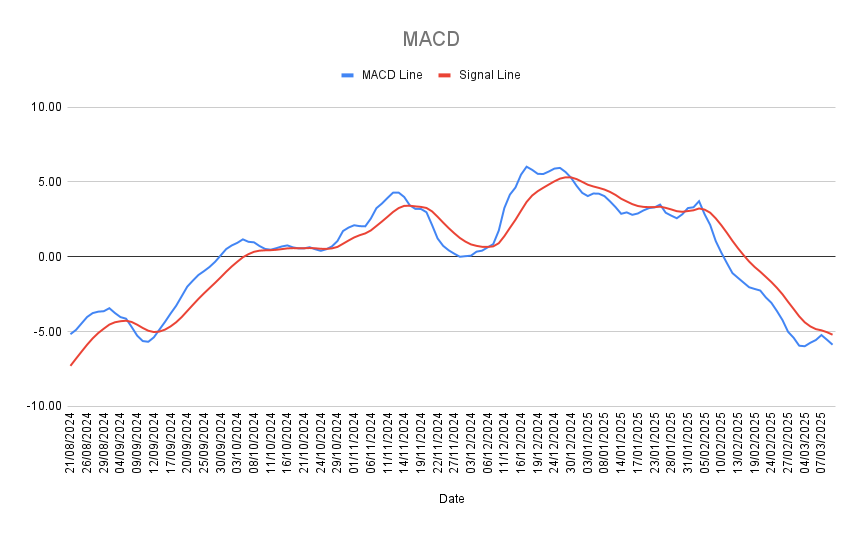

MACD Line:

The MACD line, or Moving Average Convergence Divergence line, is a fundamental component of the MACD indicator. It represents the difference between two exponential moving averages (EMAs), typically a short-term 12-day EMA and a long-term 26-day EMA. The MACD line is calculated by subtracting the long-term EMA from the short-term EMA, providing insights into short-term price momentum relative to the long-term trend.

MACD Line = (Short-term EMA) – (Long-Term EMA) = EMA(close,12) – EMA(close,26)

Signal Line:

The signal line is another essential element of the MACD indicator, designed to smooth out fluctuations in the MACD line and generate trading signals. Typically, the signal line is a 9-day EMA of the MACD line. By applying this exponential moving average to the MACD line, traders can identify potential buy and sell signals. Crossovers between the MACD line and the signal line often indicate shifts in market sentiment and potential trend reversals.

Signal Line = EMA(MACD Line, 9)

Histogram:

The histogram in the MACD indicator serves as a visual representation of the difference between the MACD line and the signal line. It provides valuable insights into changes in momentum and the strength of price movements. When the histogram bars are above the zero line, it indicates that the MACD line is above the signal line, suggesting bullish momentum. Conversely, when the bars are below the zero line, it suggests bearish momentum. Traders often look for divergences between price movements and the histogram to identify potential trend reversals or confirm existing trends.

Historgram = MACD Line – Singal Line