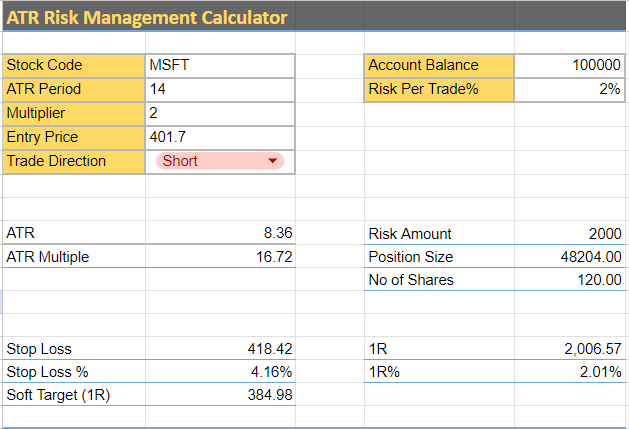

ATR Stop Calculator

Usage:

Stock Code: Enter the ticker symbol of the stock you’re trading.

ATR Period: The number of days used to calculate the Average True Range (ATR).

Account Balance: The total amount of money in your trading account, used to determine position size and risk.

Risk Per Trade%: The percentage of your account balance that you’re willing to risk on a single trade.

Multiplier: The factor applied to the ATR value to adjust the stop-loss level. A higher multiplier widens the stop-loss, while a smaller multiplier tightens it.

Entry Price: The price at which you plan to enter the trade. This value is essential for calculating your stop-loss and position size.

Trade Direction: Specifies whether you’re taking a long or short position, which determines the direction of the stop-loss calculation.

ATR: The Average True Range, a measure of market volatility. It shows the average price movement over a specified period.

ATR Multiple: This is the ATR value multiplied by the selected multiplier. It defines the distance between your entry price and stop-loss based on volatility.

Risk Amount: The monetary value you’re willing to risk on the trade, calculated from your account balance and risk percentage.

Position Size: The total monetary value of the position you’re taking, determined by your risk amount and stop-loss levels.

No of Shares: The number of shares you should purchase (or sell) based on your position size and entry price.

Stop Loss: The price level at which you will exit the trade to limit your losses, based on the ATR and multiplier.

Stop Loss %: The percentage change in price required to reach your stop-loss level. It reflects the distance between your entry price and the stop-loss.

1R: Represents your risk in monetary terms. It’s the value of 1 unit of risk, helping you track potential reward or loss.

1R%: The percentage of your account balance that equals 1 unit of risk.

Soft Target (1R): The price level at which your potential profit matches your risk (1R), serving as a guide for where to consider exiting the trade.