Stochastic RSI (STOCH-RSI)

Function Syntax

=STOCH_RSI(data, period, smoothing) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

The number of periods (days) used to calculate the RSI.smoothing(number): The number of periods used to smooth the %K values into the %D signal line.

Returns:

A three-column array of dates and their corresponding %K and %D values.

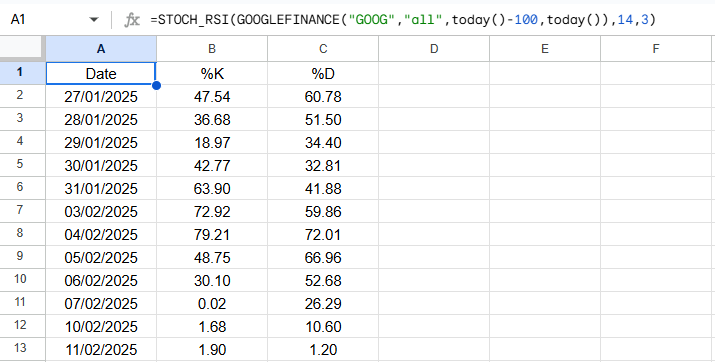

Google Sheets Output Example

Below is an example of the resulting array when applying the custom STOCH_RSI() function in Google Sheets

Apps Scripts Code

Here’s the full Google Apps Script code.

Paste this directly into the Google Sheets Apps Script editor (Extensions → Apps Script):

atr.gs

/**

* Calculates the Stochastic RSI for a given dataset and period.

*

* @param {array} data - A range containing date and close prices.

* @param {number} period - The number of periods for calculating the Stochastic RSI.

* @param {number} smoothing - The number of periods for the SMA

* @returns {array} - A 2D array with headers: Date, %K, %D.

* @customfunction

*/

function STOCH_RSI(data, period,smoothing) {

// Preprocess data using getData

// Check if the period is greater than the length of the data

if (period > data.length) {

throw new Error("Error: The specified period exceeds the length of the data.");

}

// Calculate RSI values

const rsiValues = RSI(data, period).slice(1); // Remove headers

// Extract RSI values for %K calculation

const dates = rsiValues.map(row => row[0])

const rsiOnly = rsiValues.map(row => row[1]);

// Calculate %K for each period using RSI values

const stochRSIValues = [];

for (let i = period - 1; i < rsiOnly.length; i++) {

const periodHigh = Math.max(...rsiOnly.slice(i - period + 1, i + 1));

const periodLow = Math.min(...rsiOnly.slice(i - period + 1, i + 1));

const currentRSI = rsiOnly[i];

const rsiValue = ((currentRSI - periodLow) / (periodHigh - periodLow)) * 100;

stochRSIValues.push([dates[i], rsiValue]); // Adjust date alignment

}

// Calculate %D (3-period SMA of %K)

const kValues = SMA(stochRSIValues, smoothing).slice(1); // Calculate %D directly from %K and remove header

const dValues = SMA(kValues,smoothing).slice(1);

// Align %K and %D lengths

const [alignedK, alignedD] = alignLENGTHS(kValues, dValues);

// Combine %K and %D values into final output

const stochRSI = alignedK.map((k, i) => {

return [k[0], k[1], alignedD[i] ? alignedD[i][1] : null];

});

// Prepare the final data structure

return [["Date", "%K", "%D"], ...stochRSI];

}

/**

* Calculates the Relative Strength Index (RSI) for a given dataset and period.

* @param {array} data - an array where the first column is the dates, and subsequent columns contain open, high, low, close, and volume.

* @param {number} period The number of periods to calculate the RSI, e.g., 14 for a 14-day RSI.

* @return {array} The RSI values along with corresponding dates.

* @customfunction

*/

function RSI(data, period) {

// Preprocess the range using getData

const processedData = getData(data);

// Check number of arguments

if (arguments.length !== RSI.length) {

throw new Error(`Wrong number of arguments. Expected ${RSI.length} arguments, but got ${arguments.length} arguments.`);

}

// Extract columns from the processed data

const dates = processedData.slice(1).map(row => row[0]); // Dates are already Date objects

const closePrices = processedData.slice(1).map(row => row[4]); // Close prices are already floats

if (period > closePrices.length) {

throw "Error: The specified period exceeds the length of the range.";

}

// Initialize arrays to store gains and losses with dates

let gains = [["Date", "Gain"]];

let losses = [["Date", "Loss"]];

// Calculate price changes and store them with corresponding dates

for (let i = 1; i < closePrices.length; i++) {

let priceChange = closePrices[i] - closePrices[i - 1];

let date = dates[i]; // Use the date corresponding to the current close price

if (priceChange > 0) {

gains.push([date, priceChange]);

losses.push([date, 0]); // Placeholder for losses

} else {

gains.push([date, 0]); // Placeholder for gains

losses.push([date, Math.abs(priceChange)]);

}

}

// Calculate average gain and average loss over the specified period using RMA

let avgGains = RMA(gains, period).slice(1); // Remove headers

let avgLosses = RMA(losses, period).slice(1); // Remove headers

// Calculate RSI values and add corresponding date

let RSIs = avgGains.map((gainRow, index) => {

let date = gainRow[0]; // Use the date from the gains array

let avgGain = gainRow[1];

let avgLoss = avgLosses[index][1];

let RS = avgLoss === 0 ? 100 : avgGain / avgLoss; // Prevent division by zero

let RSI = 100 - (100 / (1 + RS));

return [date, RSI];

});

// Prepare the final RSI data structure

return [["Date", `RSI(${period})`], ...RSIs];

}

/**

* Calculates the Relavtive Moving Average (RMA) for a given dataset and period.

*

* @param {array} data - an array where the first column is the dates, and subsequent columns for open, high, low, close and volume.

* @param {number} period The number of periods to calculate the RMA, e.g., 14 for a 14-day RMA.

* @returns {Array} the RMA values along with corresponding dates.

* @customfunction

*/

function RMA(data, period) {

//Check number of arguments

if (arguments.length !== RMA.length) {

throw new Error(`Wrong number of arguments. Expected ${RMA.length} arguments, but got ${arguments.length} arguments.`);

}

const processedData = getData(data);

const dates = processedData.slice(1).map(row => row[0]); // Extract dates

const closePrices = processedData[0].length === 2

? processedData.slice(1).map(row => row[1]) // For 2-column arrays, use the second column

: processedData.slice(1).map(row => row[4]); // Default: use index 4 for close price

// Initialize an array to store EMA values with corresponding dates

let results = [["Date", `RMA(${period})`]]; // Include headers

// Calculate the multiplier for RMA calculation

const multiplier = 1 / period;

// Calculate SMA for the first n data points

let sum = 0;

for (let i = 0; i < period; i++) {

sum += closePrices[i];

}

let sma = sum / period;

// The first RMA

results.push([dates[period - 1], sma]);

// Calculate RMA for the remaining data points

for (let i = period; i < closePrices.length; i++) {

const currentClose = closePrices[i];

const prevRMA = results[results.length - 1][1];

const currentRMA = (currentClose - prevRMA) * multiplier + prevRMA;

// Append the current date and RMA to the results array

results.push([dates[i], currentRMA]);

}

return results;

}

/**

* Calculates the Simple Moving Average (SMA) for a given dataset and period.

*

* @param {Array} data A range containing date and close price data from Googlefinance(), with no header row.

* @param {number} period The number of periods to calculate the SMA, e.g., 14 for a 14-day SMA.

* @returns {Array<Array>} The Simple Moving Average (SMA) of the range.

* @customfunction

*/

function SMA(data, period) {

const processedData = getData(data);

const dates = processedData.slice(1).map(row => row[0]); // Extract dates

const closePrices = processedData[0].length === 2

? processedData.slice(1).map(row => row[1]) // For 2-column arrays, use the second column

: processedData.slice(1).map(row => row[4]); // Default: use index 4 for close price

// Check if the period is greater than the length of the data

if (period > closePrices.length) {

throw new Error("Error: The specified period exceeds the length of the data.");

}

// Initialize an array to store SMA values with corresponding dates

let results = [["Date", `SMA(${period})`]]; // Include headers

// Calculate SMA for the given period

for (let i = period - 1; i < closePrices.length; i++) {

const periodPrices = closePrices.slice(i - period + 1, i + 1); // Get the slice for the period

const sma = periodPrices.reduce((acc, val) => acc + val, 0) / period; // Calculate average

// Append the current date and SMA to the results array

results.push([dates[i], sma]);

}

return results;

}

/**

* Aligns the lengths of two arrays by trimming the longer array to match the shorter one.

*

* @param {Array} arr1 - The first array.

* @param {Array} arr2 - The second array.

* @returns {Array} - An array containing two aligned arrays.

*/

function alignLENGTHS(arr1, arr2) {

const lengthDiff = arr1.length - arr2.length;

if (lengthDiff > 0) {

return [arr1.slice(lengthDiff), arr2];

} else if (lengthDiff < 0) {

return [arr1, arr2.slice(-lengthDiff)];

}

return [arr1, arr2];

}

/**

*

* @param {Array<Array>} data - A 2D array of cell values to process. The first row should contain headers.

* @returns {Array<Array>} - A 2D array where the first row contains headers and subsequent rows contain processed data.

*

* @customfunction

*

*/

function getData(data) {

if (!data || data.length === 0) {

throw new Error("Input data is empty or invalid.");

}

// Check if the first row contains headers

const headers = Array.isArray(data[0]) && data[0].every(item => typeof item === "string")

? data[0]

: null;

if (!headers) {

// If no headers, assume the first column is the date column and process data

return data.map(row => row.map((value, index) => {

return index === 0 ? new Date(value) : parseFloat(value);

}));

}

// Process rows with headers

return [headers, ...data.slice(1).map(row => headers.map((header, index) => {

const key = header.toLowerCase();

return key === "date" ? new Date(row[index]) : parseFloat(row[index]) || row[index];

}))];

}Last updated on